Stockpulse

Overview of Stockpulse

Stockpulse: AI-Powered Financial News and Community Analysis

What is Stockpulse?

Stockpulse is a financial research company specializing in AI-driven analysis of financial news and communities. By applying large language models (LLMs) and other advanced AI techniques, Stockpulse helps financial institutions make more informed decisions. It focuses on monitoring social media and extracting actionable insights to improve investment strategies.

Key Features and Benefits

- Real-Time Social Sentiment: Provides real-time sentiment analysis of social media to aid in financial decision-making.

- Comprehensive Data Coverage: Monitors millions of messages daily from diverse sources, covering thousands of equities globally.

- Historical Data: Offers over 10 years of historical data, collected continuously and not backfilled.

- Customization: Allows for individual preferences and custom solutions.

- AI-Powered Insight Pipeline: Crawls social media and news, stores and structures data, augments it with AI, and provides predictions/outlooks.

How Stockpulse Works

Stockpulse operates through an AI-powered insight pipeline that involves several steps:

- Crawling Social Media and News: Continuously monitors thousands of sources.

- Storing & Structuring Data: Collects and processes data in real-time.

- Augmenting Data with AI: Uses entity matching, NLP, and database operations.

- Prediction/Outlook: Generates leading indicators and actionable alerts.

Use Cases

- Public Markets: Generate alpha with social buzz, identify patterns, and derive actionable trading signals using contextual sentiment.

- Private Markets: Empower investment decisions with social monitoring.

- Trading Surveillance: Compliance and Market Abuse Detection

Why Choose Stockpulse?

- Speed: Data is processed in real-time.

- Stability: Unique and proprietary infrastructure with triple redundancy.

- History: Extensive historical data sets.

- Customization: Flexibility to adjust to individual preferences.

Who is Stockpulse for?

Stockpulse is designed for various financial institutions and professionals:

- Quantitative Hedge Funds

- Stock Exchanges

- Financial Publishing Companies

- Private Equity Firms

- Trading Surveillance Teams

Contact and Further Information

To learn more about enhancing investment strategies with real-time market insights, visit the Stockpulse website or contact their team directly. Stockpulse's products include a dashboard, API, MCP server, and reports. It is backed by global tier-1 quantitative hedge funds and stock exchanges.

Overall, Stockpulse offers a comprehensive solution for leveraging social media and news data to enhance financial decision-making. Its AI-driven approach, combined with extensive data coverage and customization options, makes it a valuable tool for financial institutions looking to gain a competitive edge.

AI Task and Project Management AI Document Summarization and Reading AI Smart Search AI Data Analysis Automated Workflow

Best Alternative Tools to "Stockpulse"

ChatterQuant is an AI-powered platform that monitors social media for financial sentiment, providing real-time insights for traders and institutions to manage risk and identify market-moving trends.

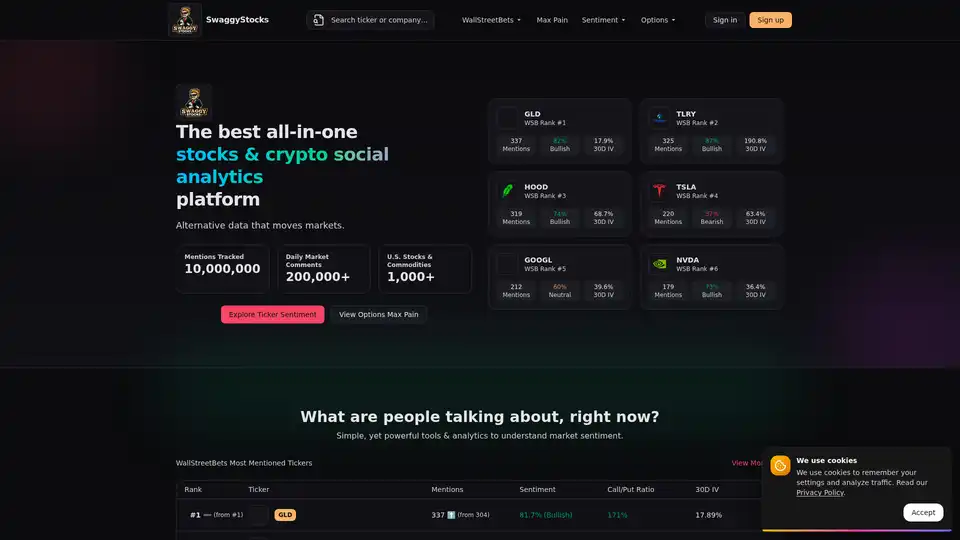

SwaggyStocks is an AI-powered social analytics platform that tracks over 10M mentions and 200K+ daily market comments to provide real-time stock sentiment analysis, WallStreetBets trending data, and options max pain calculations for informed trading decisions.

Social Sentiment Insights (SSi) is an AI-powered platform providing real-time equity research and trading insights to institutional firms, leveraging social sentiment analysis for maximized gains and minimized risk.

Momentum Radar offers technical analysis tools, social sentiment tracking, and trading strategies for financial markets, helping investors make informed decisions.