ChatterQuant

Overview of ChatterQuant

ChatterQuant: Social Media Sentiment Analysis for Financial Markets

What is ChatterQuant? ChatterQuant is a platform that leverages AI to monitor hundreds of millions of social media posts daily, extracting actionable insights related to financial markets. It provides traders, hedge funds, asset managers, and other financial institutions with real-time data and analytics to identify market trends, manage risk, and make data-driven investment decisions.

How does ChatterQuant work?

ChatterQuant uses advanced AI algorithms to:

- Monitor multiple social media platforms, including Twitter, Reddit, and (coming soon) TikTok and YouTube.

- Identify trending stocks and crypto tickers.

- Analyze positive and negative discussion volume.

- Detect changes in market narratives.

- Track coordinated stock and crypto manipulation attempts.

- Monitor short squeeze risk and volatility.

- Track malicious and authorized bot activity.

Key Features and Benefits

- Enterprise Dashboards: Provides a portal to actionable intelligence with customizable dashboards for generating alpha, managing risk, and streamlining due diligence.

- APIs & Embeds: Offers REST and websocket APIs for real-time data access and integration with existing systems.

- SIG-INT (Signals Intelligence): A rapid due-diligence dashboard to stay on top of market trends and asset narratives.

- Smart Portfolio Search: Facilitates specific portfolio generation.

- Smart Twitter Feeds: Provides custom Twitter feeds that matter to your investment strategy.

- Keyword Trends: Highlights today's market-moving trends and topics.

- Smart Reddit Feeds: (Coming Soon) Tailored Reddit feeds for relevant insights.

Who is ChatterQuant for?

ChatterQuant serves a wide range of financial professionals, including:

- Banks

- Asset Managers

- Hedge Funds

- Portfolio Managers

- Market Makers

- Brokerage Firms

- Quant Funds

- Data Redistributors

How to use ChatterQuant?

- Explore Dashboards: Access pre-built dashboards to get an overview of market sentiment and trending assets.

- Utilize APIs: Integrate ChatterQuant's data into your existing trading platforms and analytical tools using the provided APIs.

- Customize SIG-INT: Use the Signals Intelligence dashboard to create custom social monitoring feeds and track specific portfolios.

- Monitor Keyword Trends: Stay informed about the latest market-moving trends and topics.

Why is ChatterQuant important?

In today's fast-paced financial markets, social media sentiment can significantly impact asset prices and market volatility. ChatterQuant helps financial professionals stay ahead of the curve by providing real-time insights into social media discussions and sentiment, enabling them to make more informed investment decisions and manage risk effectively.

Where can I use ChatterQuant?

ChatterQuant can be used in various applications, including:

- Algorithmic Trading: Incorporate social sentiment data into trading algorithms to improve performance.

- Risk Management: Monitor social media for potential risks and vulnerabilities.

- Due Diligence: Conduct faster and more comprehensive due diligence on potential investments.

- Portfolio Management: Optimize portfolio allocation based on market sentiment.

- Market Research: Gain deeper insights into market trends and investor behavior.

By leveraging AI to analyze vast amounts of social media data, ChatterQuant provides a valuable tool for financial professionals seeking to gain a competitive edge in today's complex and dynamic markets.

AI Customer Service Chatbot AI Voice Customer Service AI Finance and Risk Analysis AI Data Analysis and BI AI Recruitment and Talent Matching

Best Alternative Tools to "ChatterQuant"

Discover TrendEdge, the AI-powered stock prediction tool that leverages alternative data—social media, web traffic, and more—for real-time market insights and investment research. Try it free!

Stockpulse.AI helps financial institutions make informed decisions by monitoring social media and extracting actionable insights using AI-driven analysis of financial news and communities.

TickerTrends is an AI-powered platform that transforms consumer interest data into actionable KPI predictions, helping investors forecast company performance with precision using alternative data sources.

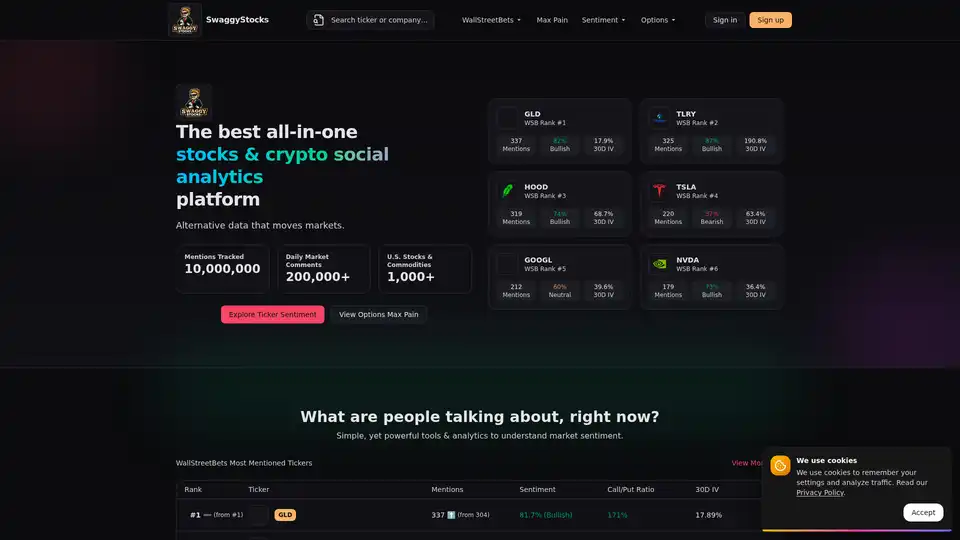

SwaggyStocks is an AI-powered social analytics platform that tracks over 10M mentions and 200K+ daily market comments to provide real-time stock sentiment analysis, WallStreetBets trending data, and options max pain calculations for informed trading decisions.