SwaggyStocks

Overview of SwaggyStocks

What is SwaggyStocks?

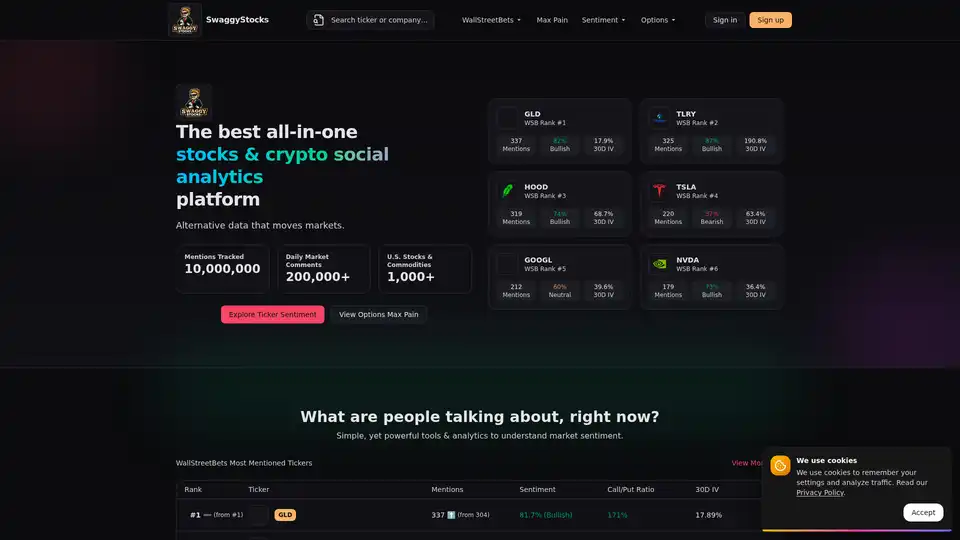

SwaggyStocks is an advanced AI-powered social analytics platform specifically designed for stock market investors and traders. The platform leverages artificial intelligence and machine learning algorithms to analyze massive amounts of social media data, tracking over 10 million mentions and processing more than 200,000 daily market comments across various trading communities.

How Does SwaggyStocks Work?

The platform utilizes sophisticated natural language processing (NLP) techniques to monitor and analyze discussions from popular trading forums, particularly focusing on the WallStreetBets community. By processing real-time data from thousands of U.S. stocks and commodities, SwaggyStocks provides actionable insights into market sentiment and trading patterns.

Core Features and Functionality

Real-time Sentiment Analysis

- Tracks bullish, bearish, and neutral sentiment percentages for each stock

- Monitors over 1,000+ U.S. stocks and commodities continuously

- Provides daily updated sentiment scores and market commentary analysis

WallStreetBets Analytics

- Ranks the most mentioned tickers in real-time (e.g., GLD, TLRY, HOOD, TSLA, GOOGL, NVDA)

- Tracks mention volume changes and ranking movements

- Analyzes call/put ratios and 30-day implied volatility (IV)

Options Max Pain Calculation

- Implements options max pain theory to predict where stock prices might get pinned on options expiration dates

- Provides historical max pain data for backtesting and analysis

- Helps identify potential price support and resistance levels

Social Media Monitoring

- Analyzes online chatter and ticker sentiment across multiple platforms

- Identifies trending stocks and the reasons behind their popularity

- Tracks retail trader sentiment and momentum indicators

Who is SwaggyStocks For?

SwaggyStocks is designed for:

- Day traders seeking real-time sentiment data for short-term trading decisions

- Swing traders looking for momentum indicators and social sentiment trends

- Options traders utilizing max pain theory for expiration week strategies

- Retail investors wanting to understand market sentiment and social media influence

- Financial analysts requiring alternative data sources for market research

Practical Value and Benefits

SwaggyStocks provides unique value by transforming social media chatter into quantifiable trading insights. The platform helps users:

- Identify potential market-moving events before they become mainstream news

- Understand retail trader sentiment and crowd psychology

- Make data-driven decisions based on social analytics rather than just technical indicators

- Spot emerging trends and momentum shifts in popular stocks

- Enhance trading strategies with alternative data sources

Why Choose SwaggyStocks?

The platform stands out through its comprehensive approach to social sentiment analysis, combining WallStreetBets data, options analytics, and real-time market commentary. With its user-friendly interface and powerful AI-driven insights, SwaggyStocks empowers traders to stay ahead of market trends and make more informed investment decisions.

AI Customer Service Chatbot AI Voice Customer Service AI Finance and Risk Analysis AI Data Analysis and BI AI Recruitment and Talent Matching

Best Alternative Tools to "SwaggyStocks"

Stockpulse.AI helps financial institutions make informed decisions by monitoring social media and extracting actionable insights using AI-driven analysis of financial news and communities.

Momentum Radar offers technical analysis tools, social sentiment tracking, and trading strategies for financial markets, helping investors make informed decisions.

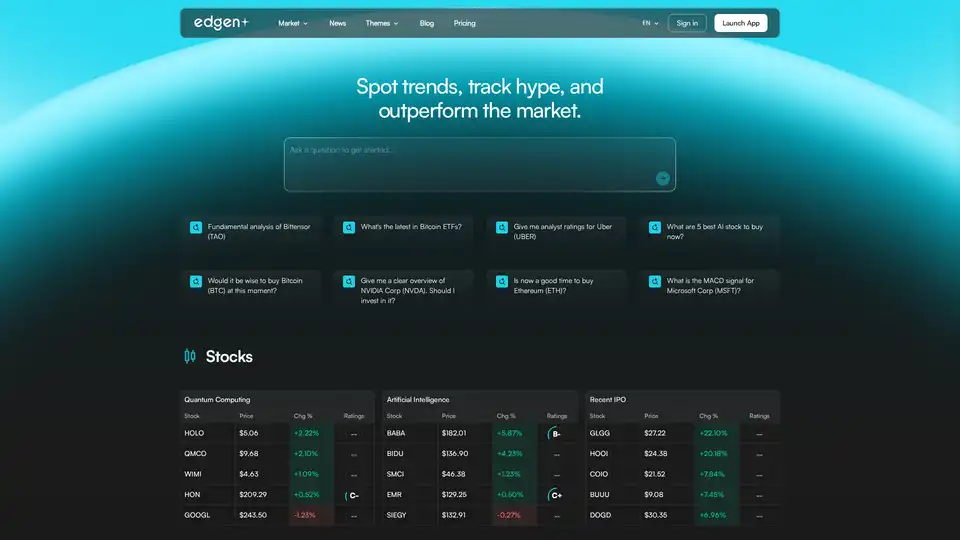

Edgen provides AI-powered tools for crypto and stock investors, offering real-time trading alerts, market signals, analytics, and portfolio analysis to spot trends and make informed decisions efficiently.

Finroo is a generative AI app for portfolio management, empowering investors to scan assets in crypto, stocks, real estate, and more. It uses advanced neural networks for trend detection, automated trading, and simplified insights to boost returns effortlessly.