MindBridge

Overview of MindBridge

MindBridge: AI-Powered Financial Risk Discovery and Anomaly Detection

What is MindBridge? MindBridge is an AI platform designed for financial professionals to identify, surface, and analyze risk across broad financial datasets. It helps financial professionals access better ways of working by providing a centralized and connected view of their enterprise’s entire financial data sets.

How does MindBridge work? MindBridge uses Ensemble AI and Unsupervised Machine Learning to analyze 100% of financial transactions for expanded risk coverage and opportunity identification. The platform eliminates the need to codify data and provides unbiased insights for better financial decision intelligence. By integrating seamlessly with existing technology ecosystems, MindBridge ensures a unified data strategy without interruption.

Key Features and Benefits:

- Automated Error Detection: Establish repeatable and scalable processes to eliminate manual labor-intensive work.

- Continuous Monitoring: Analyze 100% of financial transactions all the time for expanded risk coverage and opportunity identification.

- Surface Unknown Unknowns: Gain a centralized and connected view of your enterprise’s entire financial data sets.

- Adaptable AI: Use AI-driven use cases to scan the entire organization for risks and improvement opportunities.

- Unified Data Strategy: Seamlessly integrate and connect directly into your existing technology ecosystem, without interruption.

- Ensemble AI and Unsupervised Machine Learning: The MindBridge AI™ platform eliminates the need to codify data and provides unbiased insights for better financial decision intelligence.

Why is MindBridge important?

Sticking with outdated financial analysis processes exposes companies to fraud, financial loss, and compliance issues. MindBridge empowers businesses with adaptable AI-driven use cases, helping them stay ahead of the curve and maintain a competitive edge.

Where can I use MindBridge?

MindBridge is deployed to over 27,000 accounting, finance, and audit professionals globally. It's used across various financial processes, including:

- Accounts Payable

- Continuous Monitoring

- Expense Management

- Financial Reporting

- Manual Journal Entries

- Margin Analysis

- Revenue Management

How to get started with MindBridge?

Book a demo on the MindBridge website to see the platform in action and learn how it can benefit your organization.

Customer Success

Trusted by global leaders such as Chevron, Crowe, Falabella, Cherry Bekaert, KPMG, Grant Thornton, and Polaris, MindBridge has a proven track record of delivering transformational outcomes.

Conclusion

MindBridge offers a cutting-edge solution for financial professionals seeking to enhance their risk discovery and anomaly detection capabilities. By leveraging AI and machine learning, MindBridge empowers businesses to accelerate revenue, boost earnings, and establish proactive risk management processes. With its adaptable AI and unified data strategy, MindBridge ensures businesses stay ahead of the game, mitigate risks, and uncover hidden opportunities.

AI Customer Service Chatbot AI Voice Customer Service AI Finance and Risk Analysis AI Data Analysis and BI AI Recruitment and Talent Matching

Best Alternative Tools to "MindBridge"

FraudNet is an AI-powered platform for enterprise fraud detection, risk management, and compliance. It offers real-time fraud intelligence, customizable solutions, and proven outcomes for various industries.

Transform CSV Data into Actionable Insights with AI. DropCSV offers AI-powered analysis, interactive visualizations, and predictive intelligence for effortless data exploration.

AlgoVue is a ChatGPT-powered no-code editor for algorithmic trading, enabling users to build complex strategies, backtest them, and visualize performance without coding expertise.

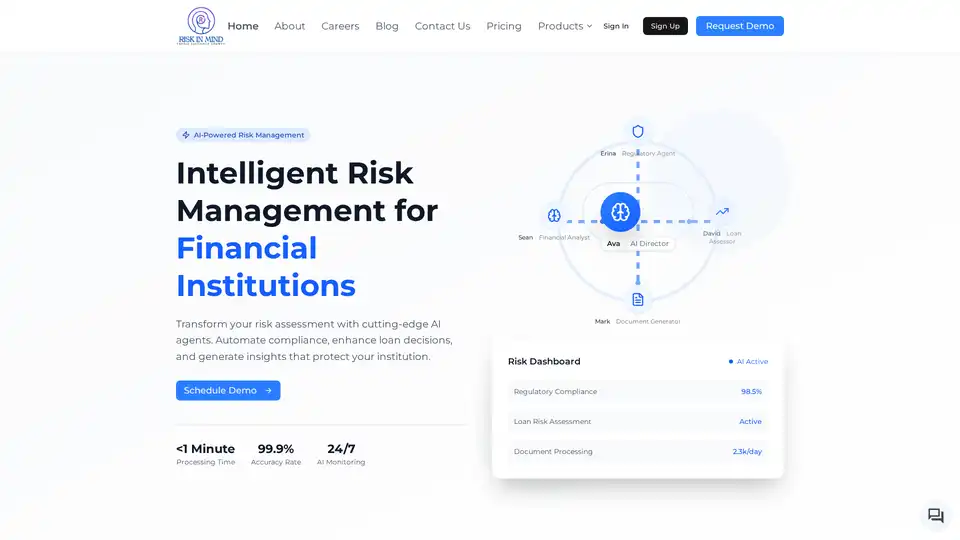

RiskInMind offers AI-powered risk management for financial institutions, automating compliance, enhancing loan decisions, and generating insights. It uses AI agents like Ava to provide expert assistance.