FraudNet

Overview of FraudNet

FraudNet: AI-Powered Fraud Detection for Enterprises

What is FraudNet?

FraudNet is a comprehensive AI-driven platform designed to protect businesses from evolving fraud threats in real-time. It integrates fraud detection, risk management, and compliance into a single, powerful solution. Trusted by numerous organizations, FraudNet empowers teams to make smarter decisions, improve operational efficiency, and fuel business growth with confidence.

Key Features:

- Customizable & Scalable: A no-code rules engine, flexible dashboards, and tailor-made machine learning models adapt and scale seamlessly with your business.

- End-to-End Platform: Unifies fraud detection, compliance, and risk management, streamlining operations and saving valuable time.

- AI Precision: Reduces false positives and enhances fraud prevention using highly accurate, real-time risk scoring and anomaly detection.

- Real-Time Fraud Intelligence: Leverages advanced analytics and a Global Anti-Fraud Network to enable faster, smarter decisions.

How does FraudNet work?

FraudNet's platform utilizes a combination of AI and machine learning to detect and prevent fraud. Its core components include:

- AI & Machine Learning: Supervised machine learning, anomaly detection, graph neural networks, and generative AI adapt to unique business challenges.

- Data Orchestration: Integrates and manages data from various sources for comprehensive fraud analysis.

- Data Enrichment: Enhances data with additional information to improve the accuracy of fraud detection.

- Global Anti-Fraud Network: Leverages a network of shared intelligence to identify and prevent fraud patterns across different industries and regions.

Solutions Offered:

FraudNet provides solutions for:

- Fraud Detection: Prevents fraud in real-time across all payment types, channels, and regions.

- Entity Risk: Establishes trust and manages risk through comprehensive screening and ongoing monitoring.

- Compliance: Optimizes AML (Anti-Money Laundering), KYC (Know Your Customer), and regulatory adherence.

Proven Outcomes:

FraudNet helps businesses achieve measurable success, including:

- 97% Fewer False Positives: Allowing teams to focus on impact-driving decisions.

- 80% Reduction in Fraud: Through more adaptive and accurate detection methods.

- 20% Boost in Approvals and Revenue: By ensuring a smoother customer experience.

Who is FraudNet for?

FraudNet serves a variety of industries, including:

- Payments

- Financial Services

- Fintechs

- Commerce

It is particularly useful for businesses that require robust fraud prevention mechanisms to manage risks associated with real-time payments, merchant risk, and AI-driven inbound fraud.

Why Choose FraudNet?

- Future-Proof Your Fraud & Risk Program: Customizable and scalable to adapt to evolving threats.

- Smarter Solutions, Stronger Results: Proactive solutions that tackle today’s most pressing challenges.

- Real Success: Testimonials from various companies highlight tangible value, including increased sales, reduced fraud, and improved operational efficiency.

How to use FraudNet?

To get started with FraudNet, you can request a demo through their website. This will provide you with an overview of the platform's capabilities and how it can be tailored to meet your specific business needs.

What is the best way to prevent fraud?

The best way to prevent fraud is to adopt a comprehensive and adaptive strategy that leverages AI and machine learning. FraudNet offers such a platform, integrating real-time fraud detection, risk management, and compliance into a single solution. It allows businesses to:

- Detect and prevent fraud in real-time across all payment types, channels, and regions.

- Establish trust and manage risk through comprehensive screening and ongoing monitoring.

- Optimize AML, KYC, and regulatory adherence.

User Reviews and Testimonials:

FraudNet has received positive feedback from its users, highlighting its usability, reporting capabilities, and the tangible value it delivers. Some notable testimonials include:

- A global financial institution praised FraudNet for its superior usability and faster, more straightforward reporting, enabling them to visualize and share findings easily.

- Fareportal reported gaining $100 million in new sales, reducing fraud by 30%, and improving team efficiency within 90 days of implementing FraudNet.

- Arvato noted that FraudNet's flexibility allowed them to meet complex customer and country requirements, increasing agility and reducing fraud attacks.

- Countingup highlighted the transformative combination of customized machine learning and flexible rules management, leading to dramatic efficiency gains and robust fraud protection.

Conclusion:

FraudNet stands out as a best-in-class AI solution for fraud detection, risk management, and compliance. Its ability to adapt to evolving threats in real-time, coupled with its customizable and scalable platform, makes it an indispensable tool for businesses seeking to safeguard their operations and drive growth with confidence.

AI Customer Service Chatbot AI Voice Customer Service AI Finance and Risk Analysis AI Data Analysis and BI AI Recruitment and Talent Matching

Best Alternative Tools to "FraudNet"

InsightAI is an AI solution for financial institutions, offering real-time fraud detection, adaptive risk management, and compliance automation. It analyzes data from various sources to prevent revenue loss and reduce operational costs.

KYC Hub is an AI-powered compliance automation platform designed for AML and fraud prevention. Streamline KYC processes with risk detection, real-time monitoring, and global AML screening.

DataVisor: AI-powered fraud & risk platform for real-time fraud attack response, improving detection & efficiency.

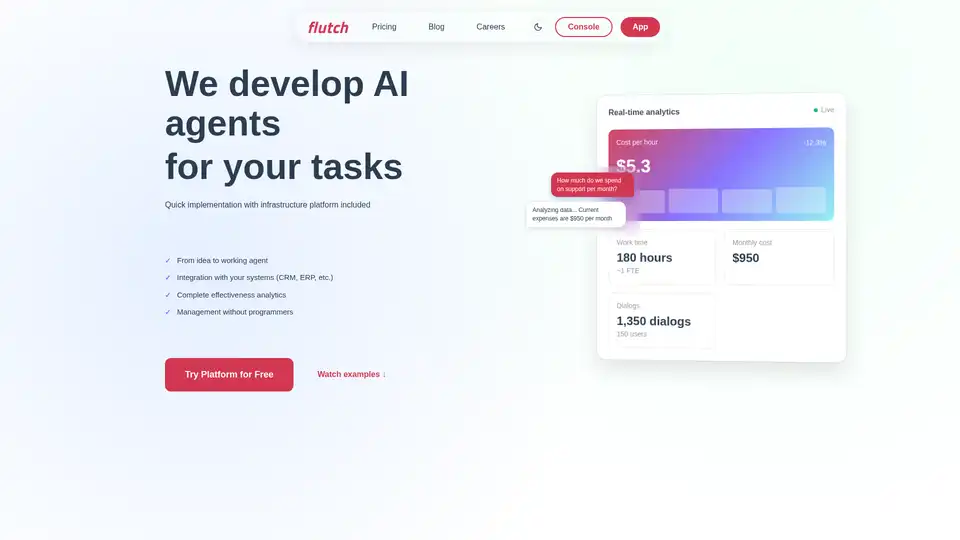

Flutch develops custom AI agents for business automation, offering quick implementation, integration with existing systems, and detailed analytics. Automate sales, support, and analytics tasks with AI agents tailored to your specific needs.