Wunderschild

Overview of Wunderschild

Wunderschild: AI-Driven Financial Crime Intelligence

Wunderschild, developed by Schwarzthal Tech, is an AI-driven platform designed for financial crime intelligence. It leverages network assessment, data linkage, flow aggregation, and machine learning to revolutionize compliance and investigation techniques. This platform offers intelligence solutions to identify strategic risks related to Politically Exposed Persons (PEPs), Serious Organised Crime, and Terrorism Financing.

What is Wunderschild?

Wunderschild is a cutting-edge platform that provides comprehensive insights into financial crime by analyzing complex networks and data. It helps organizations understand and mitigate risks associated with money laundering, tax evasion, and other illicit activities.

How does Wunderschild work?

Wunderschild employs several advanced techniques to deliver its intelligence solutions:

- Network Assessment: By mapping the relationships between entities, Wunderschild helps users "Know Your Network" and identify potential risks.

- Data Linkage: The platform connects disparate data sources to provide a holistic view of financial activities.

- Flow Aggregation: Wunderschild aggregates financial flows to detect suspicious patterns and anomalies.

- Machine Learning: Advanced machine learning algorithms enhance compliance functions by proactively assessing risks.

Key Features

- Know Your Network: Provides a global view of companies' beneficiaries network, facilitating KYC and Enhanced Due Diligence (EDD).

- Multi-dimensional Risk Rating: Offers comprehensive risk assessments based on various factors.

- Extensive Data Coverage: Includes 110 million nodes, 97 million connections, and data from 125 media sources.

- Text Mining in 5 Languages: Supports text analysis in multiple languages.

- Media Scan: Aggregates financial crime news and extracts relevant entities and relationships.

- Document Drill: Utilizes advanced OCR and multilingual capabilities to extract key information from documents.

- Transaction Monitoring: Detects suspicious activities, recognizes fraud patterns, and assesses risks.

Why Choose Wunderschild?

Wunderschild offers a forward-looking approach to financial crime compliance and investigation. Its key benefits include:

- Proactive Risk Assessment: Semi-supervised learning techniques enable proactive compliance functions.

- Deep-Dive Investigation: A global business registry enriched with machine learning allows for thorough investigations into complex transnational crime cases.

- Comprehensive Data: Access to an extensive network of data points and connections.

Who is Wunderschild for?

Wunderschild is designed for:

- Financial Institutions: To enhance KYC and AML compliance.

- Law Enforcement Agencies: To investigate financial crimes.

- Compliance Officers: To proactively assess and mitigate risks.

- Businesses: To perform due diligence and ensure regulatory compliance.

Best way to use Wunderschild?

- Start with Network Assessment: Use the "Know Your Network" feature to map relationships and identify potential risks.

- Utilize Media Scan: Stay updated with the latest financial crime news and identify relevant entities.

- Perform Document Drill: Extract key information from documents to support investigations.

- Monitor Transactions: Detect suspicious activities and fraud patterns using transaction monitoring tools.

In summary, Wunderschild by Schwarzthal Tech provides a powerful AI-driven solution for financial crime intelligence. Its advanced features and comprehensive data coverage make it an essential tool for organizations seeking to enhance compliance and mitigate financial risks.

AI Task and Project Management AI Document Summarization and Reading AI Smart Search AI Data Analysis Automated Workflow

Best Alternative Tools to "Wunderschild"

Graphyte is an AI-powered platform by Quantifind streamlining AML and KYC processes. It offers risk screening, investigations, and automation for financial crime prevention.

BeetleLabs offers AI-driven solutions for financial compliance, KYC/KYB automation, and enhanced customer support in the BFSI sector. Streamline processes and manage risk with their all-in-one platform.

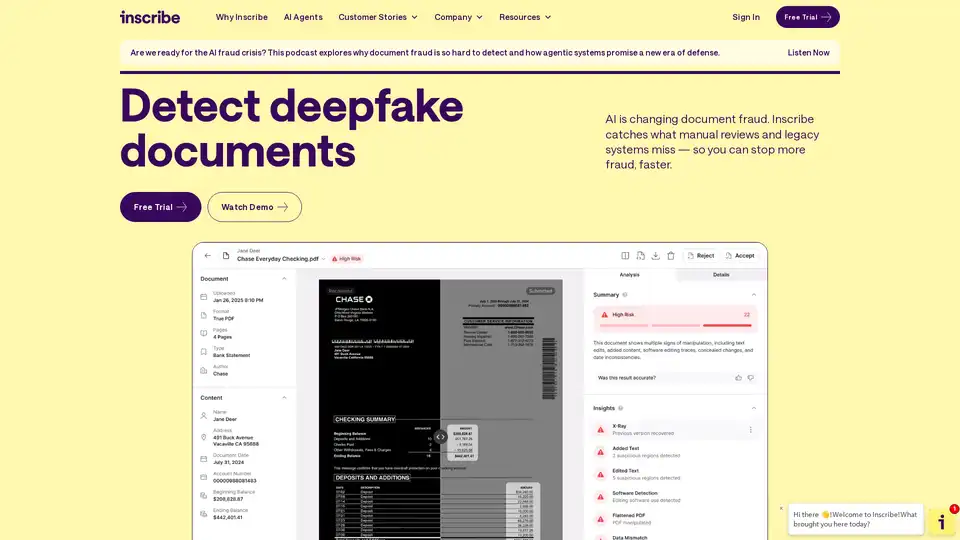

Inscribe detects advanced document fraud and other risks during onboarding and underwriting with AI Agents. Request a demo to learn more!

Maximize your stablecoin returns with Yield Seeker. Our AI-powered agent finds the safest, highest DeFi yields in real time. Simple, automated, and secure.