TaxGPT

Overview of TaxGPT

TaxGPT: AI-Powered Tax Assistant for Tax Professionals and Businesses

What is TaxGPT?

TaxGPT is an AI-powered tax assistant designed to boost productivity for tax professionals and businesses by tenfold. It offers AI tax co-pilot features for research, writing, and document analysis.

Key Features of TaxGPT

- AI Tax Co-Pilot: Reduces tax research time significantly.

- Research: Provides quick answers to complex tax questions.

- Memo Writing: Helps in drafting tax memos efficiently.

- Client Profiles: Aids in creating client profiles.

- Error Reduction: Minimizes errors in tax-related tasks.

- Time Savings: Saves significant time on tax compliance.

How Does TaxGPT Work?

TaxGPT uses a proprietary AI model trained on millions of documents, tax laws, and CPA-verified sources to provide accurate answers to even the most complex tax questions. It leverages industry-leading standards and trusted platforms like AWS and Azure to secure all data, ensuring confidentiality.

Agent Andrew: AI-Powered Audit and Review Tool

TaxGPT introduces Agent Andrew, an AI-powered audit and review tool designed to analyze prepared tax documents. Agent Andrew generates detailed, downloadable reports with actionable insights, using color-coded flags to highlight key findings.

- Red Flags: Identifies errors in tax returns, such as transcription, omission, classification, and mismatched information.

- Yellow Flags: Highlights cautionary items to review, including classifications, carryovers, and missing information.

- Green Flags: Uncovers tax savings opportunities, such as absent home office deductions and retirement contributions.

Tailored Responses and Draft Communications

TaxGPT provides automated responses tailored to specific tax situations, helping users identify eligible deductions and avoid overpaying taxes. It also helps in drafting tax memos, responding to IRS notices, and handling client communications.

Benefits of Using TaxGPT

- Accurate Answers: Up-to-date answers to complex tax questions.

- Secure and Confidential: Data security using industry-leading standards.

- Tailored Responses: Automated responses tailored to tax situations.

- Draft Communications: Quick drafting of tax memos and client communications.

- Saves Time: Instant answers to tax questions.

Who Can Benefit from TaxGPT?

- Tax Firms: Streamline tax workflows and save time.

- Businesses: Manage taxes more efficiently and reduce errors.

Customer Testimonials

Users have reported significant time savings and invaluable assistance. Jackie Compton, a CPA, highlighted the great responses and solid links for more information on Section 174. Harley M. Sherman, another CPA, mentioned that the time saved in the past 6 weeks covered the investment in TaxGPT.

How to Embed TaxGPT into Workflows

TaxGPT can be integrated into existing workflows, providing a user-friendly experience for customers. This integration helps reduce client response times and boosts customer satisfaction.

Why is TaxGPT Important?

TaxGPT is important because it saves tax professionals time, reduces errors, and provides accurate answers to complex tax questions. Its AI-powered features make tax compliance faster, easier, and smarter.

Where Can I Use TaxGPT?

TaxGPT can be used for:

- Tax research

- Memo writing

- Client profiling

- Audit and review (via Agent Andrew)

- Client communications

How to Get Started with TaxGPT?

You can start with a free 14-day trial and cancel anytime. Free sign-up is available on the TaxGPT website.

Conclusion

TaxGPT is a valuable AI tax assistant for tax professionals and businesses, offering accurate answers, secure data handling, and significant time savings. With features like Agent Andrew, it revolutionizes tax workflows and enhances productivity.

AI Task and Project Management AI Document Summarization and Reading AI Smart Search AI Data Analysis Automated Workflow

Best Alternative Tools to "TaxGPT"

Inkwise uses AI to transform your uploaded files into expertly crafted reports and articles. Extract key information seamlessly with smart content extraction, predictive writing, and AI chat.

SREDSimplify is an AI-powered SR&ED tax credit platform designed for tech companies. It simplifies R&D claim processes with automated form generation and eligibility screening.

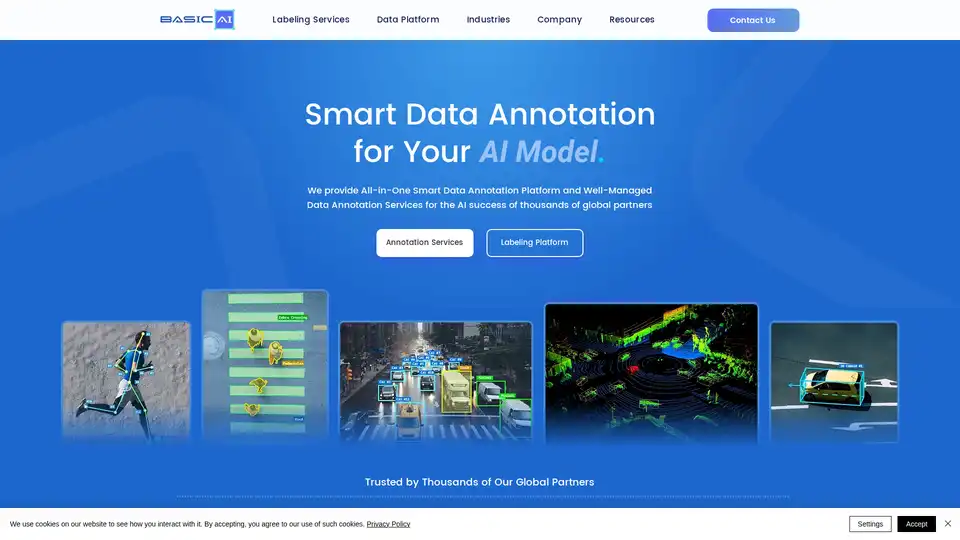

BasicAI offers a leading data annotation platform and professional labeling services for AI/ML models, trusted by thousands in AV, ADAS, and Smart City applications. With 7+ years of expertise, it ensures high-quality, efficient data solutions.

CPA Pilot is an AI tax assistant designed for CPAs, EAs, and U.S. tax firms. Automate tax research, planning, client emails, and workflows to improve client relationships. Trusted by 6,000+ tax professionals.