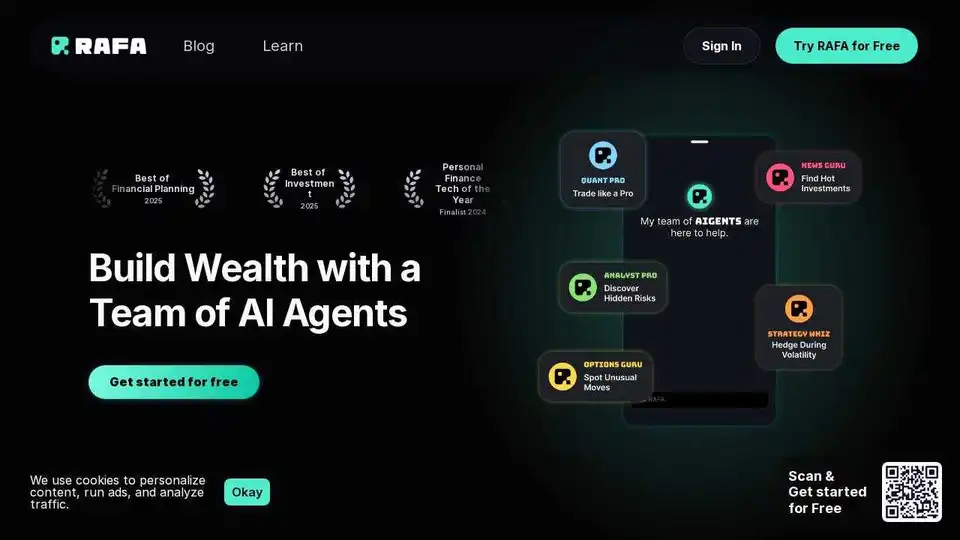

RAFA PRO

Overview of RAFA PRO

RAFA PRO: The Agentic SuperIntelligence Revolutionizing Wealth Management

What is RAFA PRO?

RAFA PRO is an AI-driven agentic operating system designed specifically for wealth management firms. It leverages the power of Agentic SuperIntelligence to automate workflows, freeing up advisors' time and enabling them to focus on client relationships and business growth. By handling heavy lifting tasks like compliance, tax strategies, and portfolio management, RAFA PRO aims to transform advisory practices, increasing efficiency, scalability, and overall revenue.

What are the key features of RAFA PRO?

- Agentic Workflows: Automates repetitive tasks across compliance, administration, and client management.

- Lead Generation: Instantly provides qualified prospects and ready-made tax strategies.

- Portfolio Management: Manages client portfolios and expectations in real-time with minimal effort.

- Multi-Modal Powerhouse: Processes any file format, instantly making it AI-ready.

- CRM AI Overlay: Integrates with existing CRM systems to enhance data analysis and client insights.

- Advanced Analytics: Provides portfolio analytics, 401k forensic analysis, and behavioral finance insights.

- Customizable Workflows: Allows advisors to tailor the platform to their specific practice and rules.

How does RAFA PRO work?

RAFA PRO operates as an intelligent operating system for wealth management firms, utilizing specialized AI agents to streamline workflows. It integrates leading AI models like Gemini, Anthropic, and OpenAI, ensuring the best engine is used for each task. The platform connects to various data sources, including CRM systems, custodian data, and market intelligence, providing a comprehensive view of client information and market trends.

RAFA PRO differentiates itself from basic AI tools by providing an end-to-end service integration, offering a holistic approach to wealth management. It's designed to adapt to each firm's unique playbook, ensuring that the AI agents follow specific rules and guidelines.

Who is RAFA PRO for?

RAFA PRO is designed for:

- Financial Advisors: Looking to optimize their practice and increase AUM.

- RIAs (Registered Investment Advisors): Aiming to scale their operations and enhance client service.

- Wealth Management Firms: Seeking to leverage AI for greater efficiency and profitability.

Why choose RAFA PRO?

- Save Time: Reduce time spent on compliance and administration by up to 95%.

- Increase Revenue: Generate significant revenue gains by improving client conversion and portfolio management.

- Enhance Client Service: Monitor client portfolios and send personalized communications automatically.

- Scale Your Practice: Expand your AUM without increasing workload.

- Gain Competitive Edge: Access institutional-grade insights and advanced AI workflows.

How to use RAFA PRO?

- Book a Demo: Contact RAFA AI to schedule a personalized demo of the platform.

- Integration: Connect RAFA PRO to your existing tech stack, including CRM and custodian data.

- Customization: Tailor the AI workflows to fit your firm's specific rules and guidelines.

- Implementation: Implement the platform with a structured transformation program provided by RAFA.

- Training: Train your team to use the platform effectively and leverage its AI-powered capabilities.

Testimonials

"RAFA Pro is like having the best CFA I could never afford, it's been an absolute godsend for my independent practice. We're doing more with less, growing faster than ever, and the platform just keeps getting better!"

Ty Hensley, President & Founder, Hensley Retirement Planning

"Before RAFA Pro we were suffocating under manual processes. If we had this technology earlier, we could have scaled our practice exponentially and served three times as many families...The time spent on Annual Review Prep and Client Follow Ups, used to take hours and hours of precious time that should have been spent with clients. Now it’s done in 70 seconds!"

Torr Steinhilber, President & Founder, Munro Asset Management

What are the benefits of RAFA PRO?

- Increased Efficiency: Automate tasks and free up time for client engagement.

- Improved Scalability: Grow your practice without increasing workload.

- Enhanced Insights: Access advanced analytics and market intelligence.

- Better Client Service: Provide personalized communications and proactive portfolio management.

- Reduced Costs: Lower compliance and administrative expenses.

RAFA PRO is positioned as the ultimate AI solution for wealth management, offering a comprehensive and integrated platform to elevate advisory practices. Its agentic AI workflows, advanced analytics, and customizable features make it a powerful tool for advisors looking to thrive in the future of wealth management.

AI Customer Service Chatbot AI Voice Customer Service AI Finance and Risk Analysis AI Data Analysis and BI AI Recruitment and Talent Matching

Best Alternative Tools to "RAFA PRO"

Powder is an AI agent revolutionizing wealth management by extracting data from documents and meetings, cutting manual tasks by 95%, ensuring compliance, and boosting productivity for financial advisors.

FastTrackr AI automates workflows for financial advisors, focusing on client relationships and business growth by managing meetings, planning, tasks, and emails.

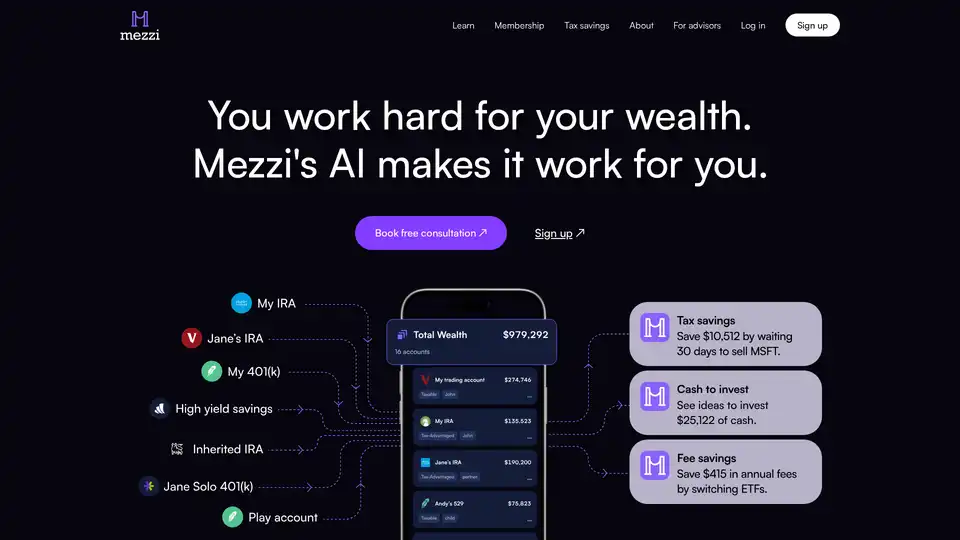

Mezzi is an AI wealth management platform offering real-time insights to optimize investments and reduce tax, helping users make smarter financial decisions without expensive advisors.

Bloks is an AI-driven 360° relationship intelligence platform that captures calls, emails, docs, and web data to build a searchable knowledge base, enhancing client relationships and workflows for professionals in finance, consulting, and more.