Oversight

Overview of Oversight

Oversight: AI-Powered Risk and Spend Control Platform

What is Oversight?

Oversight is an AI-powered platform designed to help organizations control spend, mitigate risk, and ensure compliance across various financial processes. It leverages advanced financial analytics to uncover risks, ensure compliance, and automate audits for smarter, more efficient financial governance.

How does Oversight work?

Oversight uses a comprehensive approach to monitoring spend, simplifying audits with an AI-powered platform that detects risk and modernizes control processes across all spend channels. It provides:

- Continuous Monitoring: Identifies and prioritizes high-risk transactions, fake receipts, and wasteful spend.

- Automation: Automates the invoice-to-statement matching process, ensuring accurate payment, credit, and balance records.

- Insights: Delivers powerful automation and insights to maximize finance team effectiveness.

Key Features and Benefits

- Travel & Expense Monitoring: Provides full visibility on every employee purchase, taking control of T&E spend with continuous monitoring.

- Procure-to-Pay Monitoring: Fortifies the P2P process against leakage, detecting unusual spending patterns and data entry inconsistencies.

- Purchase Card Monitoring: Gaining real-time visibility into every Purchase Card transaction. Cross-check transactional data across T&E and P2P activity to uncover risks, enhance compliance, and ensure wiser spend, organization-wide.

- Vendor Statement Reconciliation: Automates the entire invoice-to-statement matching process, ensuring accurate payment, credit and balance records across all vendors.

Use Cases

- Fraud Detection: Identify and prevent fraudulent transactions within travel and expense, procure-to-pay, and purchase card programs.

- Compliance: Ensure adherence to company policies and regulatory requirements.

- Efficiency: Automate manual processes, freeing up finance teams to focus on more strategic initiatives.

- Cost Savings: Reduce wasteful spending and prevent cash leakage.

Southwest Airlines Case Study

Southwest Airlines uses Oversight to root out risk in their Travel & Expense (T&E) and Purchase Card (P-Card) programs, identifying over $9.1M in issues.

...we have been able to mitigate risk, see behavioral changes within the company to align with company policy, find duplicates, and get those corrected before they're fully processed.

Jennifer Gruich Sr. Supervisor, Corporate Card Services Southwest Airlines

How to get started with Oversight

The first step is to book a demo. By booking a demo you can explore how Oversight can help your company increase efficiency and create better outcomes.

Why is Oversight important?

In today's complex financial landscape, organizations face increasing pressure to control costs, mitigate risks, and ensure compliance. Oversight provides a powerful AI-driven solution that enables finance teams to proactively identify and address potential issues before they escalate, leading to significant cost savings and improved financial governance.

Oversight helps identify and eliminate waste, fraud, and errors from T&E, P2P, and card programs by providing real-time visibility and powerful insights into spending patterns. The AI algorithms analyze transactional data to detect anomalies, inconsistencies, and suspicious activities, allowing organizations to take corrective action promptly.

What is the best way to use Oversight?

The best way to use Oversight is to integrate it across all spend channels, including travel and expense, procure-to-pay, and purchase cards. By monitoring all financial activity in a single platform, organizations can gain a holistic view of their spending and identify potential risks and inefficiencies across the enterprise.

AI Task and Project Management AI Document Summarization and Reading AI Smart Search AI Data Analysis Automated Workflow

Best Alternative Tools to "Oversight"

KYC Hub is an AI-powered compliance automation platform designed for AML and fraud prevention. Streamline KYC processes with risk detection, real-time monitoring, and global AML screening.

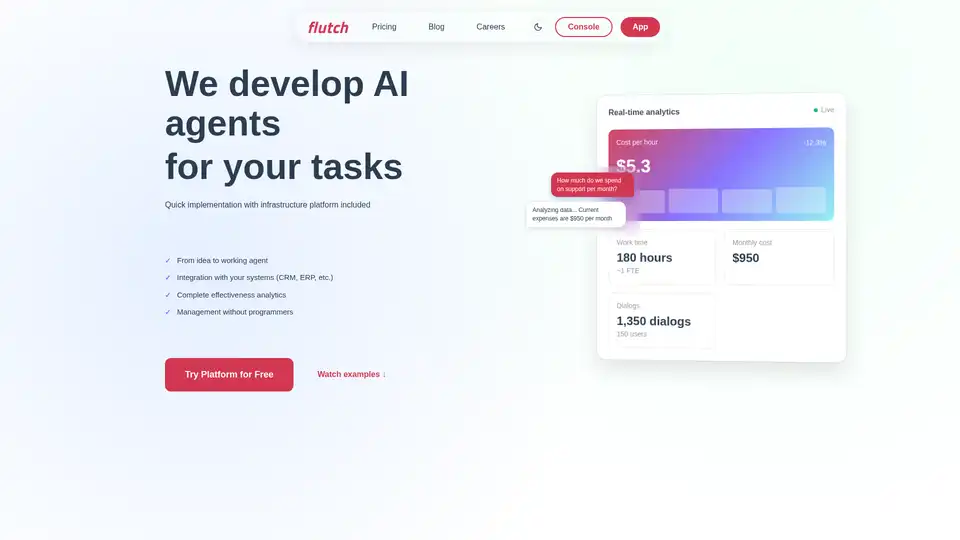

Flutch develops custom AI agents for business automation, offering quick implementation, integration with existing systems, and detailed analytics. Automate sales, support, and analytics tasks with AI agents tailored to your specific needs.

Your Personal AI specializes in tailored AI and machine learning solutions for businesses. From data collection to AI model development, empower your company with innovative tools. GDPR compliant and high-quality services.

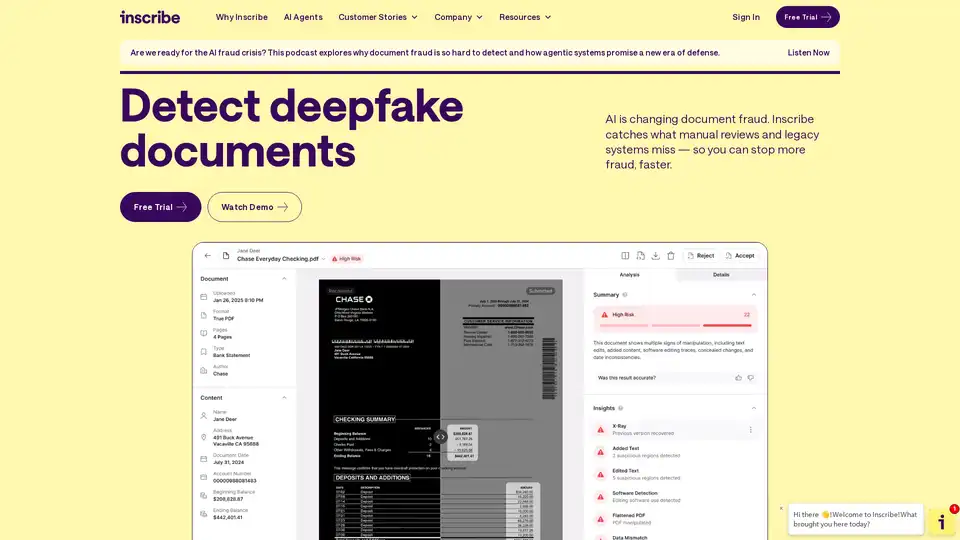

Inscribe detects advanced document fraud and other risks during onboarding and underwriting with AI Agents. Request a demo to learn more!