Osfin

Overview of Osfin

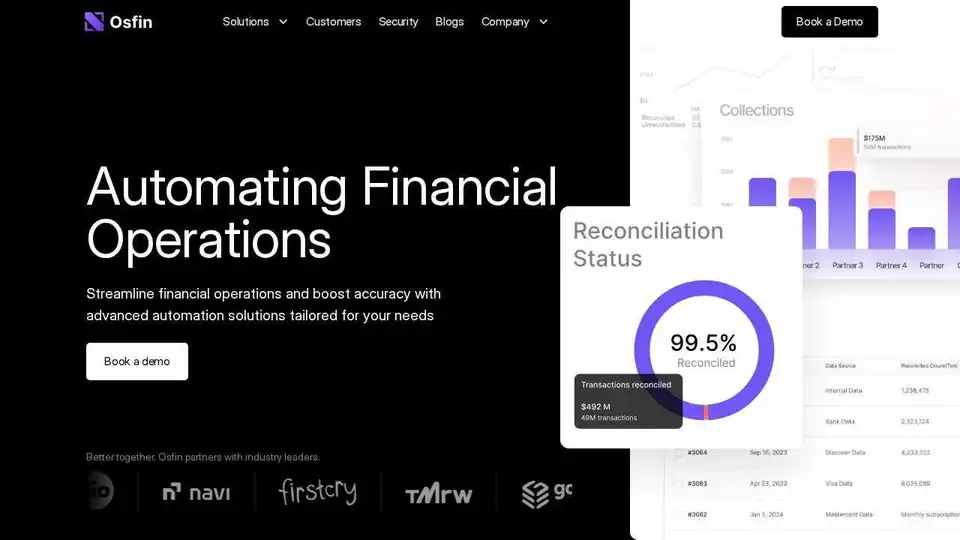

Osfin: Automate Financial Operations and Reconciliation with AI

What is Osfin? Osfin is an all-in-one finance and accounting automation platform designed to streamline financial operations and boost accuracy. It offers advanced automation solutions tailored for various industries, including banking, payments, fintech, insurance, capital markets, gaming platforms, and retail.

How does Osfin work? Osfin leverages a low-code platform with over 170 integrations to enhance data processing, optimizing ingestion and reporting. It provides lightning-fast data computation, from ingestion to matching and output delivery. Osfin's intelligent interface offers comprehensive dashboards and reports for clear, actionable insights into financial data.

Key Features and Benefits:

- High-Speed Reconciliation Automation: Osfin automates the reconciliation of ACH, deposits, loans, payments, invoices, and more, customized for your business needs.

- Unified Data: Streamlines payment processing and unlocks new efficiencies in lending by unifying data within a transformed fintech ecosystem.

- Automated Insurance Reconciliation: Handles intricate insurance transactions seamlessly, elevating insurance operations.

- Secure Market Processing: Maintains high-volume trades, positions, and crypto transactions with lightning-fast processing.

- Real-Time Gaming Transactions: Facilitates seamless reconciliation of high-volume gaming transactions with speed and precision.

- Retail Reconciliation Excellence: Reconciles retail transactions across channels with unmatched accuracy.

- Improved Cash Flow Visibility: Processes millions of entries quickly to enhance cash flow visibility and boost team efficiency.

- Operational Efficiency: Streamlined integration with over 170+ integrations for enhanced data processing and reporting.

- Lightning-Fast Data Computation: Rapid data processing from ingestion to matching and output delivery.

- High ROI: Achieves significant savings by preventing revenue leakage and enhancing productivity.

- Agile Configuration: Tailors reconciliation, payouts validation, and data reporting processes with high adaptability and seamless configuration.

- Intelligent Interface: Comprehensive dashboards and reports for clear, actionable insights.

- Proactive Support: Dedicated customer support ensures effective implementation and utilization of Osfin solutions.

How to use Osfin?

- Integration: Integrate Osfin with your existing financial systems using its low-code platform and extensive library of integrations.

- Configuration: Customize your reconciliation, payouts validation, and data reporting processes to fit your specific business requirements.

- Automation: Leverage Osfin's automation capabilities to streamline your financial operations, reducing manual effort and improving accuracy.

- Monitoring: Use Osfin's dashboards and reports to gain real-time insights into your financial data and identify areas for improvement.

Why is Osfin important?

Osfin helps businesses gain complete control over their financial processes, enhancing cash flow visibility, boosting team efficiency, and preventing revenue leakage. Its GDPR compliance, ISO 27001 certification, SOC 2 compliance, 256 Bit SSL Encryption, and PCI DSS & PCI SSF Standards ensure a secure and reliable platform.

Where can I use Osfin?

Osfin is suitable for a wide range of industries, including:

- Banking

- Payments & Cards

- Fintech

- Insurance

- Capital Markets

- Gaming Platform

- Retail

Customer Testimonials:

- PharmEasy: "Real-time visibility of cashflows at an SKU level is achieved with Osfin's intuitive dashboards."

- Games 24*7: "Managing voluminous transaction data has become seamless using Osfin."

- Manipal Cigna Health Insurance: "Osfin is a life savior. With its support, we've been able to better administer payments to our partners."

- Buku Warung: "Osfin offers efficient financial reconciliation, enhancing accuracy and productivity."

Security and Compliance:

- GDPR Compliant

- ISO 27001 Certification

- SOC 2 Compliance

- 256 Bit SSL Encryption

- PCI DSS & PCI SSF Standards

By automating financial operations and reconciliation, Osfin enables businesses to focus on growth and strategic initiatives. Its comprehensive features and robust security measures make it a valuable asset for any organization looking to improve its financial processes.

AI Task and Project Management AI Document Summarization and Reading AI Smart Search AI Data Analysis Automated Workflow

Best Alternative Tools to "Osfin"

InsightAI is an AI solution for financial institutions, offering real-time fraud detection, adaptive risk management, and compliance automation. It analyzes data from various sources to prevent revenue loss and reduce operational costs.

Automate data entry from PDFs to Windows desktop apps with Mediar Agent. AI-powered, no APIs needed. Reduce errors, ensure compliance, and free up your team.

Docyt AI is an AI-powered bookkeeping software designed for multiple businesses, offering automated accounting processes, real-time financial insights, and multi-entity management. Trusted by accounting firms, franchise brands, and hotels.

KAOFFEE uses AI to automate accounting tasks, providing cost savings, increased productivity, and enhanced security for businesses. Discover how AI can revolutionize your financial processes.