Ocrolus

Overview of Ocrolus

Ocrolus: Intelligent Document Automation for Financial Institutions

Ocrolus is an AI-powered document automation platform designed to accelerate financial decision-making. By leveraging the power of artificial intelligence, Ocrolus transforms unstructured documents into actionable insights, enabling faster and more precise analysis for enhanced efficiency and accuracy. This platform helps lenders manage risk and prevent fraud by automating the analysis of financial documents.

What is Ocrolus?

Ocrolus is a document AI platform that automates the analysis of financial documents. It uses machine learning and computer vision to classify, capture, detect, and analyze data from various document types, regardless of format or image quality. This allows financial institutions to quickly retrieve data, increase accuracy, accelerate processes, scale on-demand, and bolster compliance.

Key Features and How Ocrolus Works:

- Classification: Ocrolus uses machine learning to precisely sort financial documents, ensuring that each document is correctly categorized.

- Capture: The platform employs computer vision and human validation to extract and structure data from documents, turning unstructured information into usable data.

- Detection: Ocrolus identifies suspicious activities through tampering detection and validation, helping to prevent fraud.

- Analysis: By normalizing and cleaning data, Ocrolus provides deep insights into cash flow and income, offering a clear picture of financial health.

Why Choose Ocrolus?

Ocrolus offers a modern back-office infrastructure that streamlines document processing. Its AI-driven approach ensures:

- Increased Accuracy: Making smarter decisions with trusted data.

- Accelerated Processes: Eliminating manual review and "stare and compare" work.

- Scalability: Scaling operations up or down on-demand, 24/7/365.

- Compliance: Protecting data with bank-level security and a robust audit trail.

Use Cases:

- Cash Flow Analysis: Evaluate financial health using bank data and cash flow analytics.

- Income Calculation: Calculate income for consumers with diverse employment profiles.

- Address Validation: Extract and validate address information from any document.

- Employment Data Retrieval: Quickly retrieve employment data from disparate sources.

- Identity Verification: Establish and confirm identity using multiple document types.

Who is Ocrolus for?

Ocrolus is designed for financial institutions, lenders, and other businesses that need to process large volumes of financial documents quickly and accurately. It is particularly useful for:

- Banks and Credit Unions: Streamlining loan origination and other processes.

- Online Lenders: Automating document analysis for faster loan decisions.

- Fintech Companies: Integrating document automation into their platforms.

Customer Testimonial:

Jim Granat, President of SMB Lending and Senior Vice President at Enova International, notes that "Ocrolus technology elevated our bank statement analysis capabilities to the next level."

Best way to automate financial document analysis?

The best way to automate financial document analysis is by implementing a solution like Ocrolus that combines AI, machine learning, and human validation to ensure accuracy and efficiency. This approach reduces manual effort, accelerates decision-making, and improves compliance.

By automating these processes, Ocrolus enables businesses to make faster, more informed decisions, ultimately improving their bottom line.

AI Task and Project Management AI Document Summarization and Reading AI Smart Search AI Data Analysis Automated Workflow

Best Alternative Tools to "Ocrolus"

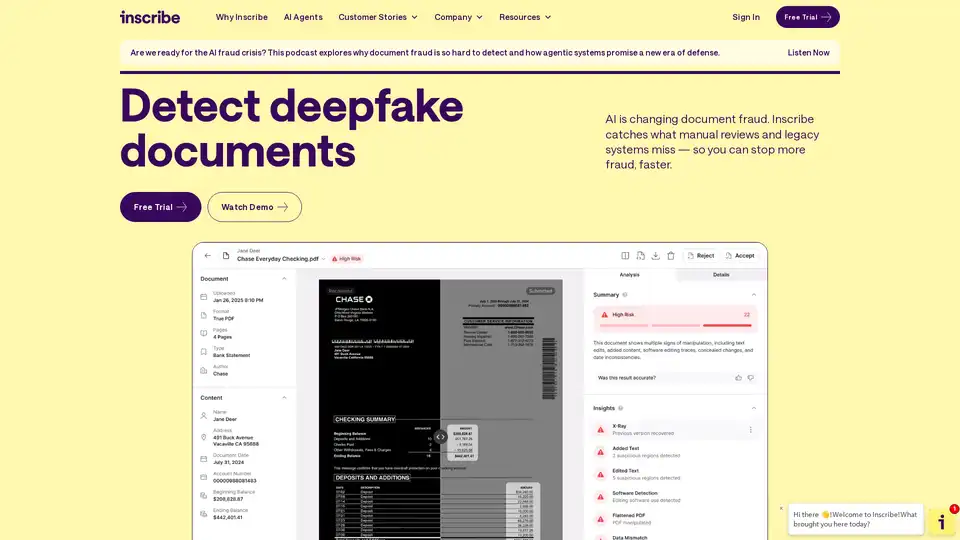

Inscribe detects advanced document fraud and other risks during onboarding and underwriting with AI Agents. Request a demo to learn more!

Casca is an AI-native Loan Origination System that automates 90% of manual efforts for FDIC-insured banks and lenders in business loan processing, boosting efficiency and conversions.

Documente is an AI-powered intelligent document processing software that automates data extraction, analysis, and insights generation from various document formats. It features natural language Q&A, custom chatbot creation, and supports multiple industries.

Intics ADI processes 100% of your documents, regardless of format. First Agentic Document Intelligence product with No-Touch capabilities.