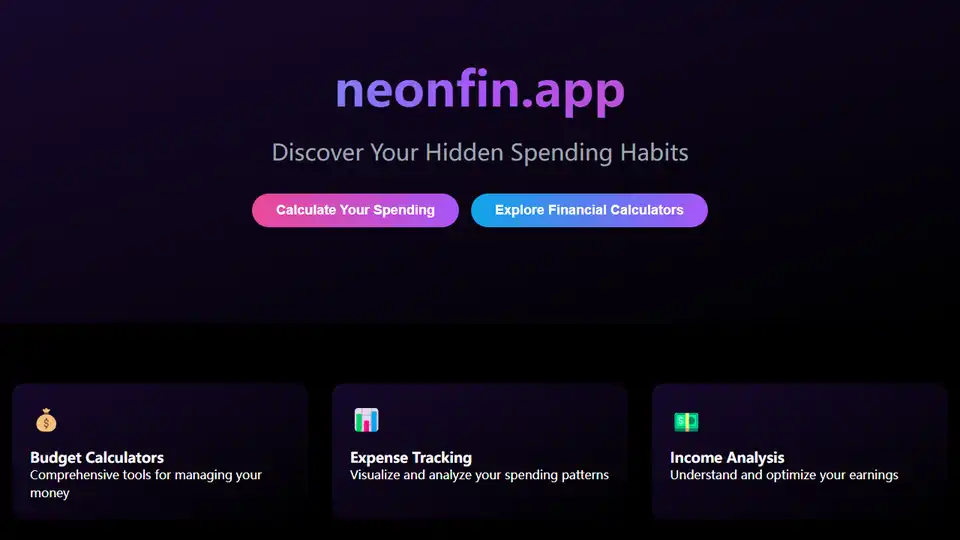

NeonFin

Overview of NeonFin

NeonFin: Your Smart Financial Calculator Suite

What is NeonFin?

NeonFin is a comprehensive suite of financial calculators designed to help you understand and manage your money more effectively. Whether you're tracking expenses, analyzing income, or planning for the future, NeonFin provides the tools you need to make informed financial decisions.

Key Features

- Budget Calculators: Comprehensive tools for managing your money and creating a budget that works for you.

- Expense Tracking: Visualize and analyze your spending patterns to identify areas where you can save.

- Income Analysis: Understand and optimize your earnings to achieve your financial goals.

- 25+ Financial Calculators: Access a wide range of calculators to help with various financial tasks.

- Free to Use: NeonFin is 100% free, making financial planning accessible to everyone.

- 24/7 Availability: Access NeonFin online anytime, anywhere.

Understanding Your Spending Habits

How does NeonFin work?

Understanding your spending patterns is crucial for financial self-discovery. NeonFin helps you map your financial DNA by revealing where your money goes and why.

Core Spending Categories:

- Fixed Expenses (50-60% of income):

- Housing (rent/mortgage, property taxes, insurance)

- Utilities (electricity, water, gas, internet)

- Insurance premiums (health, life, disability)

- Basic phone plan

- Essential subscriptions

- Variable Necessities (20-30% of income):

- Groceries and household items

- Transportation (fuel, maintenance, public transit)

- Healthcare expenses

- Personal care items

- Clothing (basic needs)

- Debt Obligations (10-20% of income):

- Credit card payments

- Student loans

- Personal loans

- Car payments

- Discretionary Spending (20-30% of income):

- Entertainment and recreation

- Dining out

- Shopping (non-essential)

- Hobbies and personal interests

- Travel and vacations

Tracking Methods:

- Digital Tracking:

- Banking apps

- Budgeting software

- Spreadsheet templates

- Receipt scanning apps

- Manual Tracking:

- Expense journals

- Receipt collection

- Budget planners

- Cash flow worksheets

Strategic Budget Allocation

Why is NeonFin important?

Your budget is a financial roadmap that should align with both your current needs and future goals. NeonFin helps you allocate your resources effectively.

Recommended Allocations:

- Essential Living Expenses (50-60%):

- Housing (25-35%):

- Rent or mortgage payment

- Property taxes

- Home insurance

- Essential maintenance

- HOA fees (if applicable)

- Utilities (5-10%):

- Electricity

- Water and sewage

- Natural gas

- Internet service

- Phone service

- Transportation (10-15%):

- Car payment

- Fuel costs

- Insurance

- Maintenance

- Public transit passes

- Food and Groceries (10-15%):

- Grocery shopping

- Basic household items

- Personal care products

- Pet food (if applicable)

- Housing (25-35%):

- Financial Goals and Savings (20-30%):

- Emergency Fund (10%):

- Build and maintain 3-6 months of living expenses

- High-yield savings account

- Easily accessible funds

- Regular monthly contributions

- Retirement (10-15%):

- 401(k) contributions

- IRA accounts

- Employer matching

- Investment diversification

- Other Financial Goals (5-10%):

- Down payment savings

- Education funds

- Travel savings

- Major purchases

- Emergency Fund (10%):

Advanced Financial Planning Strategies

How to use NeonFin?

NeonFin provides advanced strategies to help you optimize your financial well-being.

Emergency Fund Development:

- Stage 1: Initial Safety Net:

- Save $1,000 as quickly as possible

- Keep in easily accessible savings account

- Use for genuine emergencies only

- Stage 2: Fund Building:

- Calculate monthly expenses

- Set 3-6 months expenses as target

- Automate regular contributions

- Stage 3: Maintenance:

- Regular review and adjustment

- Replenish after use

- Adjust for life changes

Debt Management Strategy:

- Avalanche Method:

- List debts by interest rate

- Pay minimum on all debts

- Extra payments to highest interest

- Mathematically optimal approach

- Snowball Method:

- List debts by balance

- Focus on smallest debt first

- Build momentum with quick wins

- Psychologically motivating

Investment Planning:

- Investment Priority Order:

- Employer Match (401k):

- Capture full employer matching - it's free money

- High-Interest Debt:

- Eliminate debts with interest rates above 6-8%

- Tax-Advantaged Accounts:

- Max out IRA, HSA, remaining 401k space

- Taxable Investments:

- Broad market index funds, real estate, etc.

- Employer Match (401k):

Lifestyle Optimization:

- Smart Shopping Habits:

- Use price comparison tools

- Buy in bulk when beneficial

- Wait for sales on non-essentials

- Use cashback and rewards programs

- Energy Efficiency:

- LED lighting throughout home

- Smart thermostat programming

- Regular HVAC maintenance

- Energy-efficient appliances

- Transportation Optimization:

- Combine errands to save fuel

- Regular vehicle maintenance

- Consider carpooling

- Evaluate public transit options

Where can I use NeonFin?

NeonFin is available online, providing you with 24/7 access to a range of financial tools and calculators to better understand your spending habits and plan for the future. Start calculating your financial future with NeonFin today!

Ready to Calculate Your Financial Future?

Access All Calculators →

Best Alternative Tools to "NeonFin"

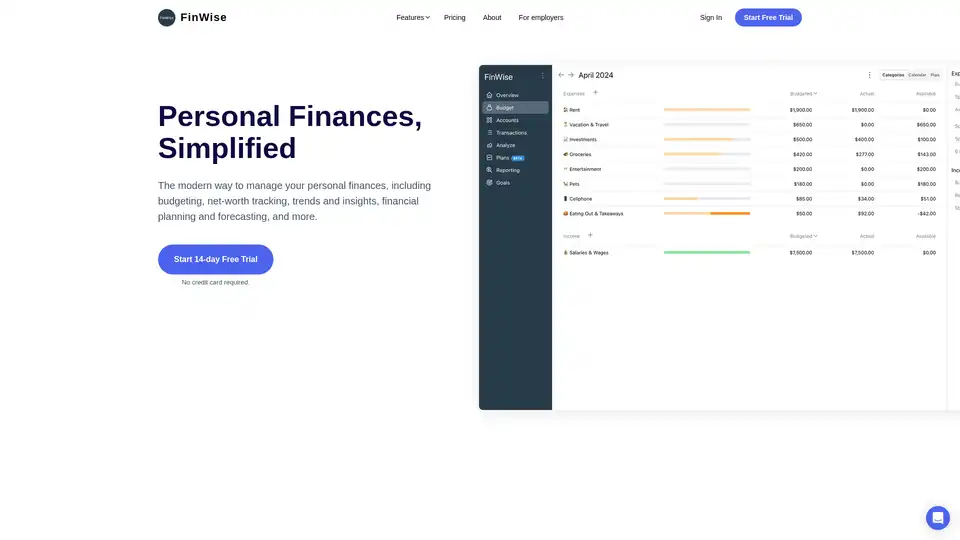

FinWise simplifies personal finance management with budgeting, net worth tracking, and financial planning tools. Securely connect accounts, track spending, and plan for the future.

WiseBot.App is an AI-powered personal finance assistant in Telegram. Track expenses, manage wallets, share budgets collaboratively, and get smart AI insights—all securely without extra apps.

2K is an AI-powered personal finance app that tracks spending, forecasts budgets, and offers expert coaching to help you make smarter money decisions and maximize savings effortlessly.

MoneyCoach is a personal finance app for managing money, budgeting, and tracking spending across Apple devices. Take control of your finances with smart budgets and goals.